Calculating the Fuel Price

Understanding how your fuel price is calculated each month should allow significant savings through strategic purchasing. There are two major parts to the calculation. The first part fluctuates month to month (but is somewhat predictable if looking at global trends), and the second part are additional costs that change annually with the new national budget.

Factors that impact Fuel Price Internationally

Free-on Board (FOB) Values – This is the price of petroleum on any given day. Initial petroleum is bought from refining centres at these values.

Freight – This is the cost to transport refined petroleum products. The general cost of freight is determined by the rates published by London Brokers Panel in pounds. However, the place of origination can affect the cost of freight, as it costs more to transport petroleum products over a larger distance. Exchange rates can also affect freight costs.

Demurrage – This is the penalty cost if ships with the petroleum products are delayed in foreign ports. The total demurrage time is 3 days. Therefore if there are delays, the original petroleum products cost will increase. These costs vary depending on the extent of the delay, however are fixed at the rates published by World Scale Association Limited.

Insurance – The cost of insuring the cargo. This is calculated to be 0.15% of the FOB value and freight costs. This is a reasonably fixed cost and should not fluctuate much month to month.

Ocean Loss – A loss allowance factor is factored into the cost of the fuel. Generally 0.3% is allowed for non-recoverable, non-insurable losses.

Cargo Dues – These are the costs associated to off-load the cargo at the harbour from the ships to shore-side storage facilities.

Coastal Storage – This is the cost of storage and handling fees at coastal terminals. The cost is approximately 2.083c/l per day with a maximum of 25 days.

Stock financing – This is the cost of financial transactions, and credit facilities. It is based on the landed cost values of refined petroleum, 25 days stock holding and prime interest rate minus 2 percent.

Exchange Rate – Seeing as the FOB, Freight, and Demurrage (at the very least) are paid in foreign currency, the strength of the ZAR is critical in contributing to the increase cost of fuel. If the ZAR is weaker, the relative cost for South Africans for these input costs will be higher and the price will go up.

Summary: The two largest variables that change petroleum product costs is the FOB values which change according to market forces and the value of the rand.

Current base level costs April 2014-March 2014

Wholesale Margin – This is the amount the wholesaler may add per litre – Petrol 31c/l; Diesel 61.2c/l

Service Cost Recoveries - This component covers oil company depot operating costs and road delivery expenses (from depot to customer). This is determined annually, subject to ministerial approval. Currently it is 28.8c/l.

Storage, handling & delivery costs – This component covers the transportation and storage of the fuel. Currently, it is also 28.8c/l.

Dealer Margin - This is the margin that service station owners/operators are permitted to add to the petrol price. The dealer margin is normally adjusted on an annual basis and is subject to the approval of the Minister of Energy.

IP Tracer Levy – This levy covers the cost of buying IP tracer dye and to inject it into Illuminating Paraffin to curtail the mixing of IP and diesel. Currently this is 0.01 c/l for diesel.

Fuel Levy – This is just an additional tax that is levied on fuel. There is no specific ear-marking for where these taxes are spent. Currently this is 224.5 c/l for petrol, and 209.5 c/l for diesel.

Slate Levy - A self-adjusting slate levy mechanism becomes operational once the under recovery on fuel reaches R250 Million. The purpose of this slate levy is to compensate oil companies for delays in pump price adjustments. Currently this is 6.58 c/l.

Customs and Excise Levy – This is to cover the cost of import duties. Currently this is 4 c/l.

Road Accident Fund Levy - This is a levy that is used to compensate third party accident victims involved in road accidents. Currently it is 104 c/l.

Demand Side Management on 95 Unleaded Petrol – This only applies to 95 octane petrol that is used inland. It was introduced in 2006 to curtail the use of ULP 95 in the inland market. Currently it is 10 c/l.

Petroleum Pipelines Levy – This levy is raised in terms of the Petroleum Pipelines Act, 2003 (Act No. 60 of 2003) and is used to finance the National Energy Regulator (NERSA). The levy is payable by users of petroleum pipelines. NERSA regulates amongst others the petroleum pipelines industry. Currently this is 0.15 c/l.

Equalisation Fund Levy - The Equalisation fund levy is normally a fixed monetary levy, determined by the Minister of Minerals and Energy in concurrence with the Minister of Finance. The levy income is mainly utilised to equalise fuel prices.

Incremental Inland Transport Recovery Levy - This levy is present in the petrol and diesel price structures and is necessary to finance the incremental inland transport of petrol, diesel and jet fuel to the inland area. The reason for this is the reality that the Durban-Johannesburg pipeline owned by Transnet Pipelines is fully utilised and oil companies are therefore forced to make use of road transport which is more expensive. Currently this is 0 c/l.

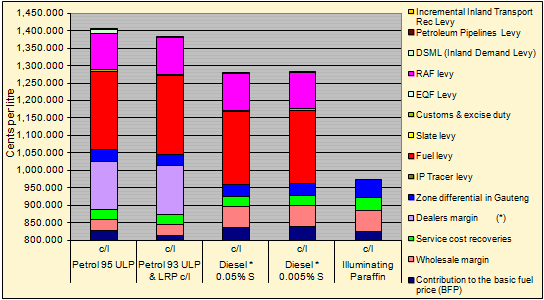

|

GAUTENG FUEL PRICES |

Petrol 95 ULP |

Petrol 93 ULP & LRP c/l |

Diesel * 0.05% S |

Diesel * 0.005% S |

Illuminating Paraffin |

|

|

c/l |

c/l |

c/l |

c/l |

c/l |

|

Contribution to the basic fuel price (BFP) |

827.350 |

814.350 |

835.630 |

839.030 |

824.128 |

|

Wholesale margin |

31.000 |

31.000 |

61.200 |

61.200 |

61.200 |

|

Service cost recoveries |

28.800 |

28.800 |

28.800 |

28.800 |

36.200 |

|

Storage, handling & delivery costs |

28.800 |

28.800 |

28.800 |

28.800 |

28.800 |

|

Distribution cost |

|

|

|

|

7.400 |

|

Dealers margin (*) |

139.100 |

139.100 |

|

|

|

|

Zone differential in Gauteng |

33.100 |

33.100 |

33.100 |

33.100 |

52.700 |

|

IP Tracer levy |

|

|

0.010 |

0.010 |

|

|

Fuel levy |

224.500 |

224.500 |

209.500 |

209.500 |

|

|

Slate levy |

6.580 |

6.580 |

6.580 |

6.580 |

0.000 |

|

Customs & excise duty |

4.000 |

4.000 |

4.000 |

4.000 |

|

|

EQF Levy |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

RAF levy |

104.000 |

104.000 |

104.000 |

104.000 |

|

|

DSML (Inland Demand Levy) |

10.000 |

|

|

|

|

|

Petroleum Pipelines Levy |

0.150 |

0.150 |

0.150 |

0.150 |

|

|

Subsidy from Equalisation Fund |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Incremental Inland Transport Rec Levy |

0.000 |

0.000 |

0.000 |

0.000 |

|

|

Sub-total |

574.650 |

564.650 |

440.670 |

440.670 |

150.100 |

|

Retail price |

1,402.00 |

1,379.00 |

|

|

|

|

Wholesale price |

1,262.90 |

1,239.90 |

1,276.390 |

1,279.790 |

974.228 |

http://www.shell.com/zaf/products-services/on-the-road/fuels/petrolprice.html

The Pricing Structure for Petrol, Diesel and IP

http://www.shell.com/zaf/products-services/on-the-road/fuels/petrolprice.html

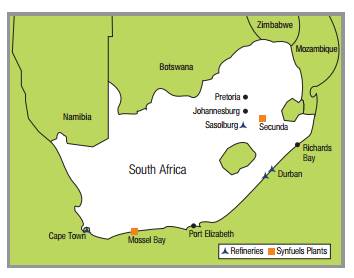

South African Refineries (www.sapia.co.za)

References

http://www.energy.gov.za/files/esources/petroleum/petroleum_pricestructure.html

http://www.energy.gov.za/files/esources/petroleum/petroleum_fuelprices.html

http://www.shell.com/zaf/products-services/on-the-road/fuels/petrolprice.html

http://www.sapia.co.za/industry-overview/fuel-price.html